It’s important for women to analysis multiple options and browse the fine print before committing to any mortgage settlement.

It’s important for women to analysis multiple options and browse the fine print before committing to any mortgage settlement. Understanding the repayment phrases, interest rates, and any further charges is critical in making an informed decis

Common Uses for Monthly Loans

People go for

Monthly Payment Loan Loans for numerous reasons. One common use is for home improvements or repairs, where the funds allow homeowners to enhance their dwelling areas with out depleting savi

The rates of interest for Day Laborer Loans can vary broadly relying on the lender and the borrower's circumstances. Generally, these loans could have rates ranging from 10% to 35%, and some may be larger due to the risks associated with lending to people with unstable revenue. It’s crucial for borrowers to compare multiple lenders to search out the most favorable te

Tips for Managing Daily Loan Repayments

Managing day by day mortgage repayments efficiently is the necessary thing to avoiding additional monetary strain. One efficient technique is to create a price range that includes the loan reimbursement as a non-negotiable expense. This proactive strategy helps make sure that funds are allocated for repayments earlier than any discretionary spending happens. Additionally, borrowers should set reminders for payment due dates to avoid late charges and potential harm to their credit score scores. Lastly, speaking openly with lenders about any potential repayment difficulties can lead to alternative preparations or options, thus alleviating monetary str

Lastly, think about the whole cost of the mortgage. Beyond curiosity, there may be additional fees corresponding to origination or processing charges that can have an effect on the general amount you re

Exploring Alternatives to Daily Loans

For those who may discover daily loans unsuitable because of excessive prices, it’s price exploring other monetary alternate options. Options such as private loans, credit unions, or neighborhood assistance programs might present more favorable terms and decrease interest rates. Additionally, establishing an emergency savings fund can serve as a financial security net, decreasing the chance of needing high-interest loans in instances of need. By considering a broader vary of economic options, individuals could make better-informed decisions that align with their long-term financial objecti

Additionally, some lenders provide academic assets and mentorship as part of the loan package, empowering women not just with capital but also with the talents and data necessary for monetary success. Overall, the creation and availability of girls's loans signify an necessary step toward inclusivity and assist within the financial sec

Low-credit loans offer essential financial assist for people going through difficult credit score conditions. These loans might help these with poor credit score histories secure funding for sudden bills, emergencies, or even opportunities that may enhance their monetary standing. It's crucial to know the intricacies of low-credit loans, including the kinds out there, eligibility criteria, the applying process, and the related risks. This article will provide a comprehensive overview of low-credit loans and highlight how 베픽 is usually a valuable useful resource for those seeking detailed information and reviews about these monetary produ

n You can pawn all kinds of things, including jewellery, electronics, musical devices, and collectibles. It is essential that the item is in good condition to get a greater mortgage amount. Each pawnshop could have different acceptance criteria, so it is advisable to check with them beforeh

The term of a Monthly Loan can range widely, typically ranging from a number of months to several years. Interest charges can also differ based on the lender, the borrower's creditworthiness, and the loan amount. It is crucial to understand these components to keep away from potential pitfalls in mortgage reimbursem

Daily loans have gained immense recognition amongst people seeking flexible financing options. They offer quick money flow options for various wants, similar to

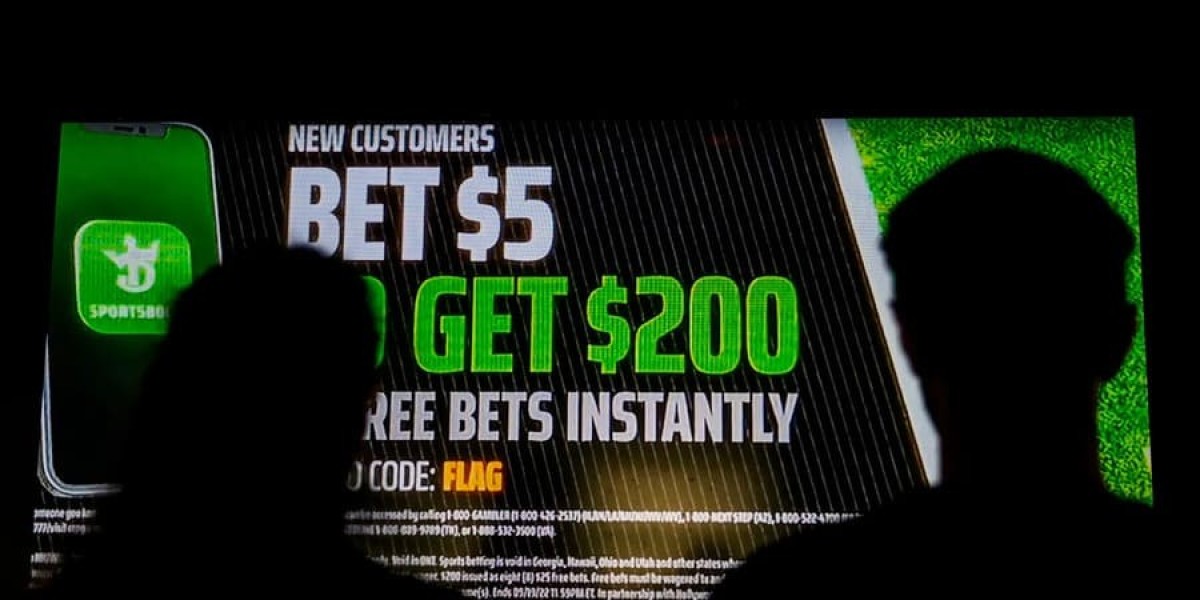

Emergency Loan bills, invoice payments, or unexpected monetary burdens. Unlike conventional loans, daily loans require shorter repayment durations, making them an appealing selection for lots of. This article will delve into the intricacies of every day loans, discussing their advantages, potential drawbacks, the applying processes, and how the proper assets – just like

visit the up coming webpage Betting website – can present valuable data and critiques related to day by day lo

In conclusion, pawnshop loans provide a convenient approach to access money quickly. While they current several advantages, potential debtors must weigh these towards the dangers and prices involved. Platforms like Bepick are invaluable for people looking for to understand their options higher and navigate the world of pawnshop loans successfu

Get Real pictures of call girl Ajmer for breathtaking pleasure

Durch nlm7976kumar

Get Real pictures of call girl Ajmer for breathtaking pleasure

Durch nlm7976kumar Indulge in Luxury with Ajmer Most Elegant Escort Companions

Durch kinu00

Indulge in Luxury with Ajmer Most Elegant Escort Companions

Durch kinu00 Horny Escort of Ajmer Ready for Sex

Durch nlm7976kumar

Horny Escort of Ajmer Ready for Sex

Durch nlm7976kumar Ajmer Escort Service Call Girls || Vanshika Jain

Durch madhu00

Ajmer Escort Service Call Girls || Vanshika Jain

Durch madhu00 Independent Escorts Profile Who's Available in Udaipur 24/7 || Vanshika Jain

Durch madhu00

Independent Escorts Profile Who's Available in Udaipur 24/7 || Vanshika Jain

Durch madhu00